Strategy-Driven.

Outcome-Oriented.

Your Wealth, Your Way.

At JM Financial Wealth, we don’t just manage capital — we give it direction. Our solutions are designed to serve the full spectrum of your financial journey — from protecting today’s assets to building tomorrow’s legacy.

Fixed Income Strategies

Defend Wealth with Intelligent Downside Protection

We curate low-volatility, income-oriented products designed to protect capital while delivering consistent returns.

Bonds & NCDs

Access high-grade corporate issuances favoured by institutional investors. Our selection offers attractive yields, robust credit quality, and confidence that your principal remains safeguarded.

Debt Mutual Funds

Access to leading debt managers across duration, credit, and sector strategies — delivering risk-adjusted performance that individual bond selection cannot match.

Corporate Fixed Deposits

Premium yields from strong corporate issuers, backed by independent ratings. Ideal for investors seeking fixed, predictable returns with calibrated risk.

Debt PMS

Tailored fixed-income portfolios aligned to your risk tolerance, income needs, and time horizon — combining institutional discipline with personalised ownership.

Equity Solutions

Your Growth Deserves Momentum

From aggressive allocations to balanced strategies, we provide diversified, research-backed avenues for long-term compounding.

Direct Equity

A focused, fundamentals-driven approach that identifies tomorrow’s leaders — companies with resilience, vision, and structural advantages.

Equity Mutual Funds

Access proven investment philosophies through experienced managers renowned for disciplined execution and consistent market-beating performance.

Equity PMS

Bespoke equity portfolios built around your return objectives, risk profile, and investment horizon — with full transparency and institutional-grade oversight.

Long-Only AIFs

Enter the world of sophisticated alternative strategies, from private equity to hedge-style mandates — opportunities traditionally reserved for UHNI investors.

NDPMS (ONYX)

Maintain full control while benefiting from expert research, timely insights, and investment recommendations — ideal for seasoned investors who prefer to steer decisions.

Hybrid Funds & AIFs

Balanced asset allocation that blends equity growth with defensive positioning, capturing upside while mitigating downside across cycles.

Alternate Investment Solutions

Raise Capital Without Disrupting Long-Term Plans

We create liquidity through structured solutions tailored to your personal or business needs.

Non-Convertible Debentures (NCDs)

Institutional-grade funding instruments offering competitive rates and flexible structures far beyond traditional lending channels.

Private Credit

Bespoke financing for complex requirements — including acquisition funding, expansion capital, and working-capital optimisation.

Loan Against Securities (LAS)

Immediate liquidity without liquidating your portfolio. Your investments continue compounding while you access capital efficiently.

All products are subject to risk assessment and regulatory guidelines

Investment Banking Solutions

For Founders, Promoters & Visionaries

We move capital to match enterprise ambition — offering strategic advice backed by decades of sector expertise.

Private Equity / Strategic Investors

Connect with marquee investors who bring transformational capital, operational insight, and a shared commitment to scale.

Mergers & Acquisitions

Execute complex transactions with precision — from market consolidation to strategic exits — engineered to maximise long-term value.

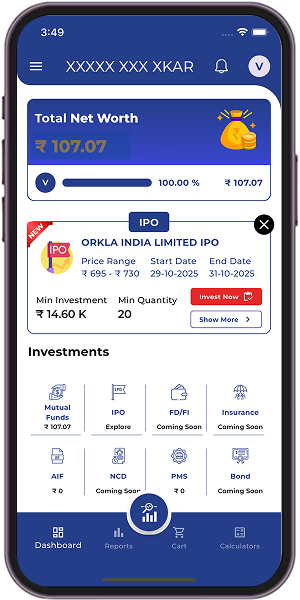

Initial Public Offerings (IPOs)

Transform private success into public-market leadership through disciplined valuation, positioning, and timing.

All advisory is subject to regulatory frameworks and due diligence.

Offshore Investments

Global Diversification, Designed for You

Diversifications across geographies, currencies, and global asset classes with solutions aligned to your risk-return profile.

Offshore Platform

When ambitions extend beyond borders, our Global Wealth Platform provides sophisticated offshore architecture — including our Variable Capital Company (VCC) Fund in Singapore.

The VCC structure delivers flexibility, tax efficiency, and institutional-grade governance, positioning you at Asia’s wealth-creation hub.Engineer your portfolio for global efficiency with structures optimised for tax, estate planning, and multigenerational wealth preservation.

Estate Planning

Wealth That Endures Begins With Foresight

Protect legacy, ensure continuity, and preserve family harmony through bespoke planning frameworks.

Succession & Legacy Planning

Precision-built strategies that minimise tax leakage and enable smooth, structured wealth transition across generations.

Trust Structuring

Sophisticated trust frameworks that protect assets, manage risk, and ensure your wealth is deployed exactly as intended — today and in the future.

Insurance as a Wealth Transfer & Protection Tool

Partner with premier insurers to safeguard family lifestyle, protect business interests, and create tax-efficient wealth-transfer pathways.

Advisory Services

Your Goals Are Unique — So Is Our Advice

We deliver independent, conflict-free guidance rooted in your life goals and liquidity needs.

Your wealth deserves more than management — it demands strategic vision.

We turn complexity into clarity through research-led insights, diversified portfolios, and disciplined risk management aligned with your long-term objectives.Our Investment Committee brings decades of experience and proprietary research to every recommendation.

Beyond markets, we evaluate your full wealth ecosystem — business interests, personal holdings, tax considerations — to craft integrated strategies that elevate overall outcomes.Engineer your financial future with intent, insight, and impact.